Considering buying a home? But where to start? Figuring out the steps can be daunting, so Daily Realty Group has put together this handy checklist for helping you on your way!

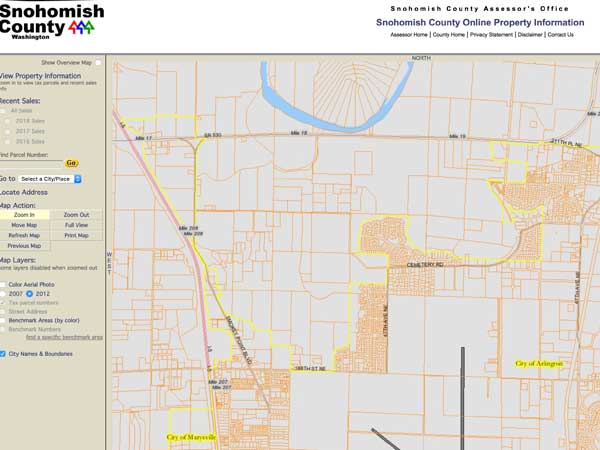

First, do your neighborhood research

- Are all the services you need available (i.e. high-speed internet, cell phone coverage, access to medical services, handicapped accessibility, public transportation)?

- Does the neighborhood meet your needs for safety?

- Are home values in the neighborhood stable or increasing?

- If you have kids, how do the schools in the area rate?

- Determine your budget. Does your budget allow for purchase in the neighborhood—is it affordable?

- How long is the commuting distance to work?